Fund

Broadside

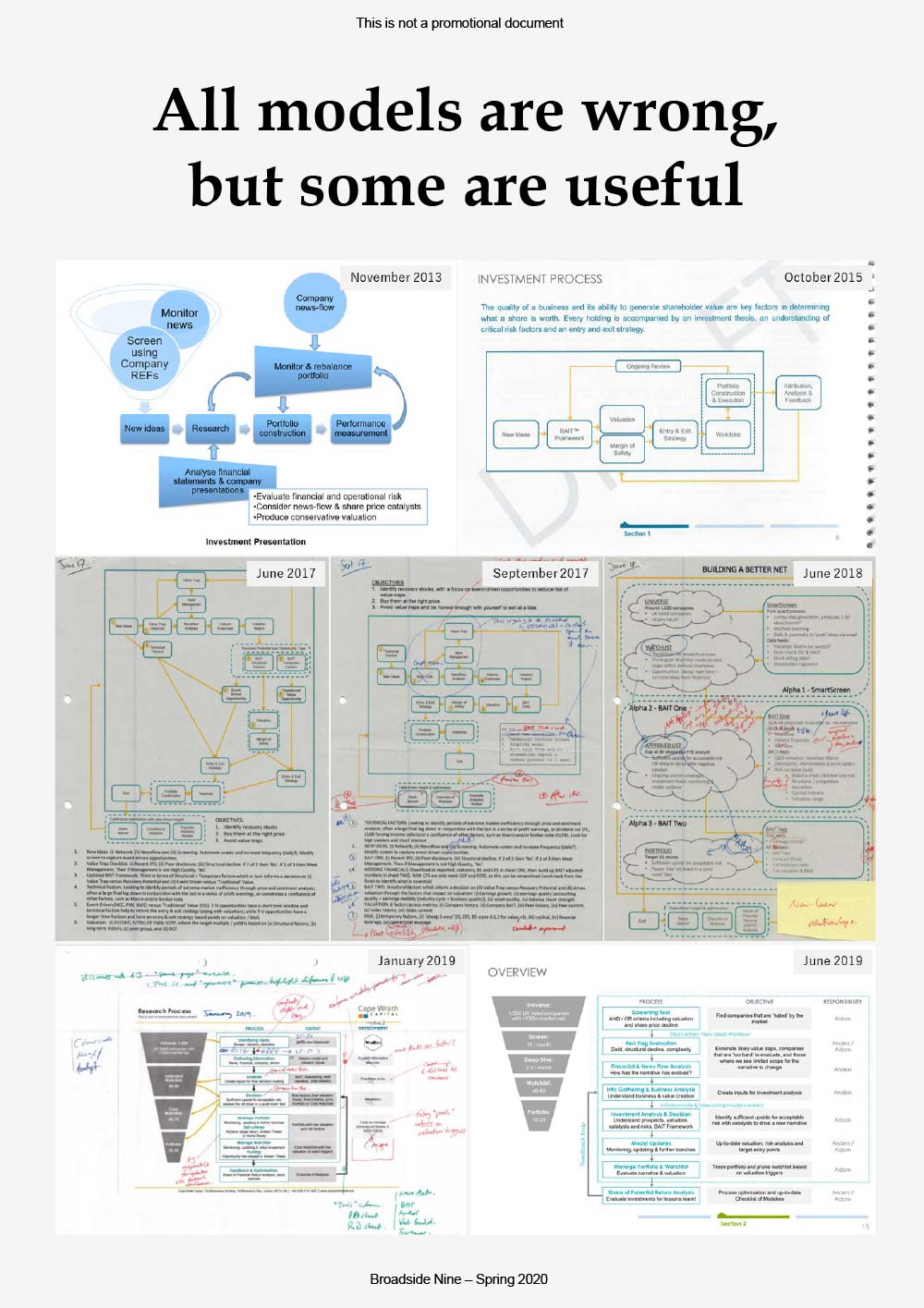

Thoughts on value investing

News

Low-Cost UK Funds with Supranormal Returns

Patrick Sanders

Trustnet

17 September 2025

Mark Atkinson & Adam Rackley

The Desert Island Investor

27 June 2025

Paul Hill & Adam Rackley

Vox Markets Video

18 October 2024

Alex Newman (Bearbull)

Investors’ Chronicle

12 September 2024

Short Duration Value Investing

Merryn Somerset Webb, Adam Rackley

Merryn Talks Money Podcast

12 July 2024

Jean-Baptiste Andrieux

Trustnet

8 July 2024

Capitulations & Narrative Shifts

Jeremy McKeown, David Seaman, A. Rackley

In the Company of Mavericks Podcast

14 June 2024

Adam Rackley, Bill Hench, Dan White

Asset TV Video

11 June 2024

Jonathan Miller

Morningstar

4 March 2024

Simon Evan-Cook

Medium

22 November 2023

Simon Evan-Cook

Citywire

25 May 2023

Paul Hill & Adam Rackley

Vox Markets Video

10 March 2023

Michael Taylor & Adam Rackley

Shifting Shares Video

10 October 2022

Chloé Meley & Adam Rackley

Citywire Podcast

3 October 2022

Adam Rackley

Money Week

29 September 2022

Adam Rackley

FT Adviser

23 September 2022

Adam Rackley

Capital Employed Podcast

22 September 2022

Capacity, liquidity, performance fees

Anthony Luzio

Trustnet

24 August 2022

Richard Evans – Questor

The Telegraph

20 July 2022

Anthony Luzio

Trustnet

20 July 2022

Abraham Darwyne

Trustnet

1 November 2021

Adam Rackley

What Investment (page 16)

October 2021

Simon Evan-Cook

Citywire

24 September 2021

VT Cape Wrath Focus Fund Profile

Lawrence Gosling

What Investment

20 July 2021

Funds Returning 50% Since ‘Vaccine Monday’

Rory Palmer

Trustnet

22 April 2021

Simon Evan-Cook

Citywire

13 April 2021

Cape Wrath Capital Refunds Fees

News Team

Fundtruffle

31 March 2021

Cape Wrath Capital Hands Back Management Fee

Gary Jackson

Trustnet

31 March 2021

Mike Sheen

Investment Week

31 March 2021

Kristen McGachey

Portfolio Advisor

31 March 2021

Gary Jackson

Trustnet

1 March 2021

Premier Foods – Letter To The Chairman

Conor Sullivan

Financial Times

10 July 2017

Merryn Somerset Webb

Money Week

17 March 2017

Not Investing Like Warren Buffett

Merryn Somerset Webb

Financial Times

20 January 2017

Harry Ritchie

Daily Mail

13 March 2014